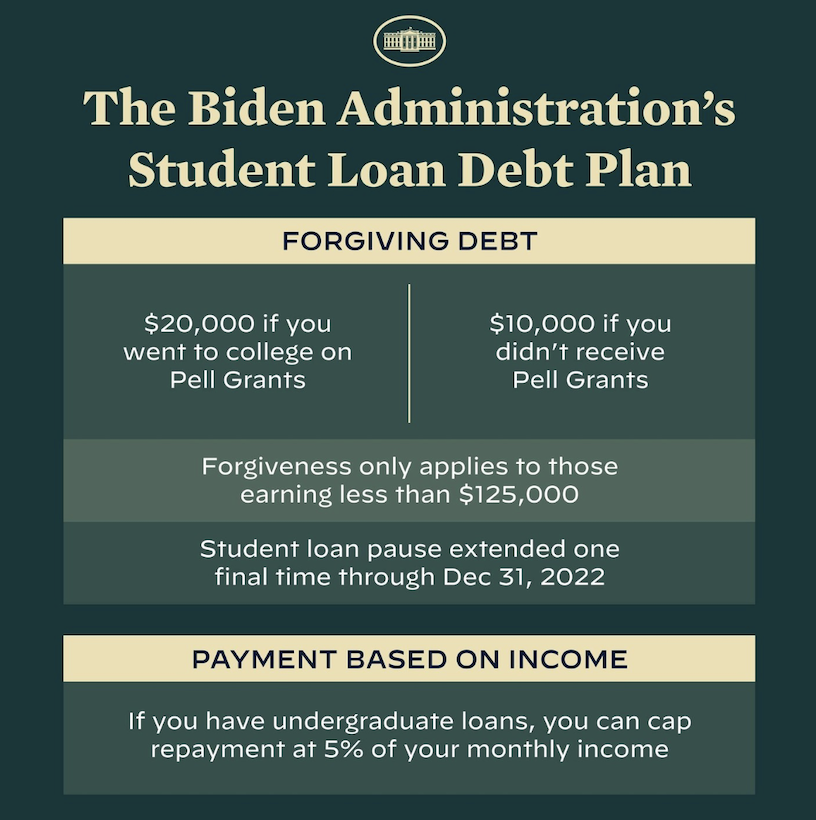

President Joe Biden just held a press conference announcing his Student Loan Forgiveness Plan. The plan will erase over $10,000 worth of student loan debt for Americans earning less than $125,000 annually. This amount is doubled to $20,000 for Pell Grant recipients. Pell Grants are usually given to undergrad students who are in deep financial need and have not yet earned a degree that could help alleviate their monetary situation. Given the Grants are specifically for those in dire condition, it makes sense the amount of their student loans eliminated would be higher. President Biden also announced he will be extending the current pause on federal loan payments until December 31st, 2022. For many, this is life-changing news. Finally, after decades of Americans suffering through crippling student loan debt, something is going to be done about it. But is it enough?

There are plenty of great things about this plan. For one, raising the yearly wage all the way up to $125,000, rather than making it any lower, boosts the number of people who will be helped. For many Americans, eliminating $10K in student loans will alleviate some of the everyday stresses and unfair anxieties debt placed on them. As Biden expressed in his statement, “The burden [of debt] is so heavy that even if you graduate, you may not have access to the middle-class life that the college degree once provided.” And this plan is aiming to end that.

On the other hand, for plenty of Americans, $10,000 is not enough. Depending on your situation, some people’s student debt lands them somewhere in the triple digits. For them, while $10K is nice, it’s just a drop in the bucket. This plan is a good first step, and a monumental one at that, but there needs to be more. Perhaps Biden could introduce an annual forgiveness plan, a yearly amount of debt that will be forgiven. Therefore, while Americans are slowly chipping away at the debt, so is the government. Similar to the Pell Grants, maybe the more student debt you have, the more debt the government will eliminate. What’s life-changing for some, is just a kind gesture to others.

Still, this is a good first step. Prior to Biden’s announcement, this issue went largely untouched. Ignored by most politicians, or switched out for more preferable hot button issues. By Biden actually acknowledging student loan debt and making a plan, he’s creating a space for this conversation. Hopefully, in doing so, more concrete plans and better ways for the government to assist will follow. As Biden said in his speech, “Education is a ticket to a better life…but over time that ticket has become too expensive for many Americans.” This is a step to change that.

For any help with your student loan debt check out some of the links below:

The Institute of Student Loan Advisers → Gives access to free student loan advice

American Consumer Credit Counseling → Offers specifically student loan counseling

National Consumer Law Center → has student loan assistance